How Does Auditing Work for Companies? A Detailed Overview

How Does Auditing Work for Companies? A Detailed Overview

Auditing is an essential financial process that provides companies with an independent assessment of their financial statements and internal controls. It ensures the accuracy, reliability, and compliance of financial information with accounting standards and regulatory requirements. For companies aiming to build trust among investors, lenders, and regulatory bodies, regular auditing services are indispensable.

Planning and Risk Assessment

The auditing process begins with thorough planning. Auditors gather preliminary data about the company’s operations, industry environment, and previous audits. This helps identify areas that could present higher risks of errors or fraud. An effective audit plan outlines objectives, scope, timing, and resources required, tailored to the company’s size and complexity.

Opening Meeting and Communication

A formal opening session with company management sets the tone for the audit. It aligns expectations, clarifies the audit scope, and establishes communication channels to ensure cooperation during the process.

Fieldwork and Data Collection

Auditors collect evidence by reviewing financial documents such as ledgers, invoices, bank statements, contracts, and tax records. In addition, they observe processes, conduct interviews with staff, and verify the effectiveness of internal controls. This phase includes sampling transactions to test accuracy without needing to check every item.

Testing and Analysis

Testing is crucial to ensure financial statement integrity. Auditors analyse samples and perform analytical procedures, comparing financial results to prior periods or benchmarks. They focus on areas prone to misstatements, such as revenue recognition and expense classification.

Audit Findings and Reporting

At the conclusion of fieldwork, auditors compile findings into a comprehensive audit report. The report provides an opinion on whether financial statements fairly reflect the company's financial position. If material discrepancies are discovered, these are disclosed with recommendations for corrective action.

Management Review and Follow-Up

The draft audit report is shared with management for review and comments. A closing meeting discusses the outcomes, highlights key points, and agrees on any needed adjustments or improvements. Follow-up audits might be scheduled to confirm that changes have been made.

Why Companies Need Audits

Sunil Maini CPA PC Audits provide more than just compliance; they enhance business credibility and operational efficiency. They help stakeholders make informed decisions by providing a trustworthy picture of financial health. Moreover, audits identify gaps in internal controls, reducing risks of fraud or financial mismanagement. This vigilance aids in sustaining long-term business growth and investor confidence.

Searching for Financial & Taxation Services? Let’s make your search simple with professionals!

Take your Financial & Taxation Services to the next level with Sulekha. Boost your online visibility, connect with more clients, and grow effortlessly!

Blogs Related to Financial & Taxation Services

Do You Know the Difference Between Grants and Student Loans?

Do You Know the Difference Between Grants and Student Loans? When planning for college financing

Are Long-Term Care Policies Worth It?

Are Long-Term Care Policies Worth It? Planning for long-term care is an essential step in securing your financial future and protecting your assets. Long-term care insurance helps cover expenses

How Can a Strong Cash Flow Strategy Make You More Profitable?

How Can a Strong Cash Flow Strategy Make You More Profitable? Cash flow is the lifeblood of any business. A strong cash flow strategy goes beyond profitability on paper by ensuring that your business has enough liquid assets to meet obligations and

How Strong Is Their Financial Footing? A Guide to Analyzing the Balance Sheet

How Strong Is Their Financial Footing? A Guide to Analysing the Balance Sheet Understanding a company’s financial footing is crucial for investors, creditors, and business owners. The balance sheet, one of the core financial statements

What Documents Do You Need for a Stress-Free Business Tax Season?

What Documents Do You Need for a Stress-Free Business Tax Season? Running a business means managing many moving parts, and tax season is often one of the most challenging times. Minimising stress and ensuring accurate filing starts with organising e

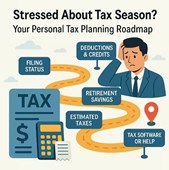

Stressed About Tax Season? Here's Your Personal Tax Planning Roadmap

Stressed About Tax Season? Here's Your Personal Tax Planning Roadmap Tax season can be a stressful time for many, especially for H1 visa holders, Green Card holders, and U.S. citizens navigating complex tax laws. However, personal tax planning throu