Personal Tax Planning: What Are the Basics You Need to Know?

Personal Tax Planning: What Are the Basics You Need to Know?

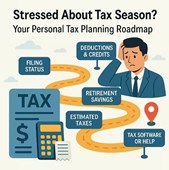

Effective personal tax planning is a crucial part of managing your finances, maximising your deductions, and legally minimising your tax liabilities. As tax laws evolve each year, understanding the core principles and basic strategies can help you keep more of your income and ensure compliance with regulations.

What Is Personal Tax Planning?

Personal tax planning involves strategically organising your income, investments, expenses, and financial activities to optimise your tax situation. It is a continuous process that begins at the start of each financial year and helps you avoid surprises at tax time, improve cash flow, and achieve your long-term financial goals.

The Basics You Need to Know

1. Know Your Taxable Income

Calculate your total income, including salary, business income, investments, rental income, and other sources. This forms the basis for understanding your tax liability.

2. Understand Tax Slabs and Rates

Stay updated on current tax slabs and rates for 2025. Different income levels are taxed at different rates, and knowing where your income falls helps you plan deductions accordingly.

3. Maximise Deductions and Exemptions

Claim all eligible deductions, such as mortgage interest, charitable donations, medical expenses, and education loans. Use exemptions like HRA, standard deduction, or tax-free allowances to lower taxable income.

4. Invest in Tax-Saving Instruments

Contribute to tax-efficient instruments like PPF, EPF, ELSS, or health savings accounts to save on taxes while growing your wealth.

5. Plan Your Income and Expenses

Adjust the timing of income recognition and expenses to optimise your tax liability. For example, defer bonuses or advance deductible expenses to a more favourable year.

6. Keep Proper Financial Records

Maintain organised records of all receipts, bank statements, investment proofs, and tax documents to substantiate your claims and ease the filing process.

7. Choose the Right Tax Regime

Compare the old and new tax regimes for 2025 and select the one that offers maximum benefits based on your income and deductions.

Why Is Personal Tax Planning Important?

Good tax planning is not just about saving money; it's about creating a sustainable financial strategy that aligns with your life goals. It ensures compliance, reduces stress during tax season, and helps you make informed financial decisions throughout the year.

If you're in Milpitas, CA, and looking for expert guidance on personal tax planning, Venkata Pathi Financial Advisor offers tailored services to help you navigate the complexities of 2025 tax laws. Our professionals will help you analyse your financial situation, identify deductions, and develop strategies to legally save more on your taxes.

Searching for Financial & Taxation Services? Let’s make your search simple with professionals!

Take your Financial & Taxation Services to the next level with Sulekha. Boost your online visibility, connect with more clients, and grow effortlessly!

Blogs Related to Financial & Taxation Services

Do You Know the Difference Between Grants and Student Loans?

Do You Know the Difference Between Grants and Student Loans? When planning for college financing

Are Long-Term Care Policies Worth It?

Are Long-Term Care Policies Worth It? Planning for long-term care is an essential step in securing your financial future and protecting your assets. Long-term care insurance helps cover expenses

How Can a Strong Cash Flow Strategy Make You More Profitable?

How Can a Strong Cash Flow Strategy Make You More Profitable? Cash flow is the lifeblood of any business. A strong cash flow strategy goes beyond profitability on paper by ensuring that your business has enough liquid assets to meet obligations and

How Strong Is Their Financial Footing? A Guide to Analyzing the Balance Sheet

How Strong Is Their Financial Footing? A Guide to Analysing the Balance Sheet Understanding a company’s financial footing is crucial for investors, creditors, and business owners. The balance sheet, one of the core financial statements

What Documents Do You Need for a Stress-Free Business Tax Season?

What Documents Do You Need for a Stress-Free Business Tax Season? Running a business means managing many moving parts, and tax season is often one of the most challenging times. Minimising stress and ensuring accurate filing starts with organising e

Stressed About Tax Season? Here's Your Personal Tax Planning Roadmap

Stressed About Tax Season? Here's Your Personal Tax Planning Roadmap Tax season can be a stressful time for many, especially for H1 visa holders, Green Card holders, and U.S. citizens navigating complex tax laws. However, personal tax planning throu