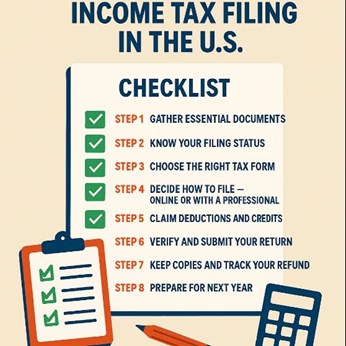

The Ultimate Checklist for Your First Income Tax Filing in the U.S.

The Ultimate Checklist for Your First Income Tax Filing in the U.S.

Filing your income taxes for the first time in the U.S. can be overwhelming — from understanding tax brackets to collecting all the right documents. Whether you’re a new resident, student, or first-time employee, a little preparation goes a long way.

Step 1: Gather Essential Documents

Before you start filing, collect all relevant paperwork. Missing a single form could delay your refund. Key items include:

- W-2 form (from your employer)

- 1099 forms (for freelance or contract work)

- Social Security Number (SSN) or ITIN

- Bank statements and investment income reports

- Deduction receipts (education, healthcare, mortgage interest)

Step 2: Know Your Filing Status

Your tax filing status determines your standard deduction and tax rate. The five common statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Choose the Right Tax Form

Most individuals file using Form 1040, while nonresidents may need Form 1040-NR. If you’re self-employed, you might file a Schedule C for business income.

Step 4: Decide How to File — Online or With a Professional

While free online tools exist, first-time filers often benefit from professional guidance to claim maximum deductions

Step 5: Claim Deductions and Credits

Reduce your taxable income by claiming:

- Standard or itemised deductions

- Education credits (American Opportunity, Lifetime Learning)

- Child Tax Credit

- Earned Income Credit (EIC)

- Retirement contributions

Using a professional ensures you don’t miss out on valuable tax-saving opportunities.

Step 6: Verify and Submit Your Return

Before submitting, double-check:

- Correct SSN and address

- Proper signatures

- Direct deposit details for refunds

Submitting electronically (e-filing) is faster and reduces errors compared to paper filing.

Step 7: Keep Copies and Track Your Refund

Store a copy of your return and all supporting documents for at least three years. Track your refund status using the IRS “Where’s My Refund?” tool.

Step 8: Prepare for Next Year

Smart taxpayers plan year-round. Setting up quarterly estimated payments, tracking deductions monthly, and consulting with a tax advisor in Cerritos, CA, ensures smoother filings in future years.

Why Choose Libre Tax Resolution

Filing your taxes doesn’t have to be stressful. With the right preparation and professional guidance, your first U.S. tax season can be smooth and rewarding. At Libre Tax Resolution, we help clients navigate complex tax rules with ease. Our services include:

- First-time tax filing guidance

- IRS representation and audit support

- State and federal tax preparation

- Small business and self-employed tax help

With expert assistance, you can maximise your refund and stay fully compliant with federal and state tax laws.

Searching for Financial & Taxation Services? Let’s make your search simple with professionals!

Take your Financial & Taxation Services to the next level with Sulekha. Boost your online visibility, connect with more clients, and grow effortlessly!

Blogs Related to Financial & Taxation Services

How Can You Use Payroll Data to Improve HR Strategy?

How Can You Use Payroll Data to Improve HR Strategy? Payroll isn’t just about paying employees—it’s a goldmine of business intelligence. When analysed strategically, payroll data reveals patterns that can transform your HR strategy

Is Your Bookkeeping a Mess? Are You Missing Out on Growth Opportunities?

Is Your Bookkeeping a Mess? Are You Missing Out on Growth Opportunities?

Need a Clearer Financial Picture? Why Compilation Services Can Help

Need a Clearer Financial Picture? Why Compilation Services Can Help. Understanding your company’s true financial health begins with accurate reporting. But not every business needs a full audit or review. For many small and mid-sized organisations,

Do You Need Clearer Financial Insights? What Can Modern Auditing Services Offer?

Do You Need Clearer Financial Insights? What Can Modern Auditing Services Offer? In today’s fast-paced business world, financial clarity is more than an advantage—it’s a necessity. Whether you run a small enterprise or a growing corporation, accurat

How Do You Find the Right Life Insurance Policy?

How Do You Find the Right Life Insurance Policy? Life insurance is more than a safety net—it’s a cornerstone of sound financial planning. Whether you’re protecting your family’s future, securing your business, or planning your estate, finding the ri

Why Is Investment Management Critical for High-Net-Worth Individuals?

Why Is Investment Management Critical for High-Net-Worth Individuals? Wealth accumulation is an achievement—but managing it effectively is an even greater challenge. For high-net-worth individuals (HNWIs), wealth management requires precision, fores