What a TikTok Ban Could Mean for Business Taxes and Compliance!

The potential ban of TikTok in the United States has generated significant uncertainty, especially for businesses that rely heavily on the platform for marketing and brand-building. Over the years, TikTok has become a powerful tool for small and medium-sized businesses, enabling them to engage audiences through innovative advertising, influencer partnerships, and creative content strategies. However, if the ban were to materialize, businesses would face the daunting task of transitioning to alternative platforms, which could have significant tax implications and compliance challenges.

Transition Costs and Tax Deductions

For businesses, shifting from TikTok to other platforms such as Instagram or YouTube may require a substantial investment. These costs could include:

Developing Content for New Platforms: Businesses will need to adapt their strategies to suit new platform requirements, including video formats and audience engagement techniques.

Upgrading Marketing Tools: Transitioning often involves adopting new tools and software for content creation and analytics.

Employee Training: Staff may need to learn new marketing strategies and platform-specific skills.

While these expenses may strain budgets, many qualify as deductible business expenses. Consulting a tax professional can help businesses document and claim these deductions effectively.

Advertising Costs on Competitive Platforms

Platforms like Instagram and YouTube may require higher advertising budgets to achieve results comparable to TikTok’s unique organic reach. Businesses should work with tax experts to properly record and deduct these increased costs, easing the financial burden of the transition.

Compliance Challenges

The TikTok ban may create new compliance issues, especially for businesses with international operations. Potential challenges include:

Data Privacy: Businesses must align with platform-specific data regulations and international standards like GDPR.

Content Licensing: Moving to other platforms may involve renegotiating licensing agreements for media assets.

Consulting legal and compliance professionals is critical to ensure smooth operations while avoiding penalties.

Long-Term Planning

Diversifying marketing strategies across multiple platforms can mitigate risks associated with over-reliance on a single platform. Businesses should focus on flexibility and resilience to navigate digital shifts confidently.

Expert Guidance

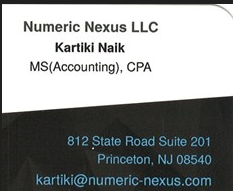

Navigating the tax and compliance implications of a TikTok ban requires proactive planning and expert support. Businesses are encouraged to consult finance and taxation professionals to maximize deductions, ensure compliance, and develop sustainable strategies for future growth. These experts can provide tailored advice to help businesses transition smoothly and stay competitive in an evolving digital landscape.

Searching for Financial & Taxation Services? Let’s make your search simple with professionals!

Take your Financial & Taxation Services to the next level with Sulekha. Boost your online visibility, connect with more clients, and grow effortlessly!

Blogs Related to Financial & Taxation Services

Money Talks—But Are You Listening? Why Financial Planning Isn’t Just for the Rich

Let’s bust a myth right now: financial planning isn’t just for millionaires. It’s for anyone who wants to stop living paycheck to paycheck, retire without panic, or simply make smarter money moves. Whether you're a salaried professional, a small

Why Filing Taxes Isn’t Just a Responsibility—It’s a Power Move!

Let’s face it: nobody jumps out of bed yelling “Yay! It’s tax season!” (unless you’re a CMA with a caffeine addiction). For most of us, taxes are more like that distant cousin you only remember when they show up — demanding attention, documents, and

How to Spot a Great Finance & Tax Expert in the U.S. (Even If You Slept Through Math Class)

So, taxes are due, deductions look like gibberish, and financial jargon makes you want to run. You tell yourself, “I’ll Google it” — but 3 tabs later, you’re watching cat videos and forgetting what HRA even means. Enter: The Finance & Tax Expert

Understanding the Child Tax Credit: Maximizing Your Benefits

What is the Child Tax Credit? The Child Tax Credit (CTC) is a U.S. tax benefit that helps families manage the financial responsibilities of raising children. It reduces tax liability for eligible parents and offers partial refunds even if no taxes a

How Global Events Like the Ukraine Conflict Affect Your Investments and Taxes

International conflicts can have far-reaching consequences, not just on geopolitics but also on the global economy. The ongoing situation in Ukraine serves as a stark reminder of how these events can influence taxation and investment landscapes, crea

What a TikTok Ban Could Mean for Business Taxes and Compliance!

Navigating the tax and compliance implications of a TikTok ban requires proactive planning and expert support. Businesses are encouraged to consult finance and taxation professionals to maximize deductions, ensure compliance, and develop sustainable